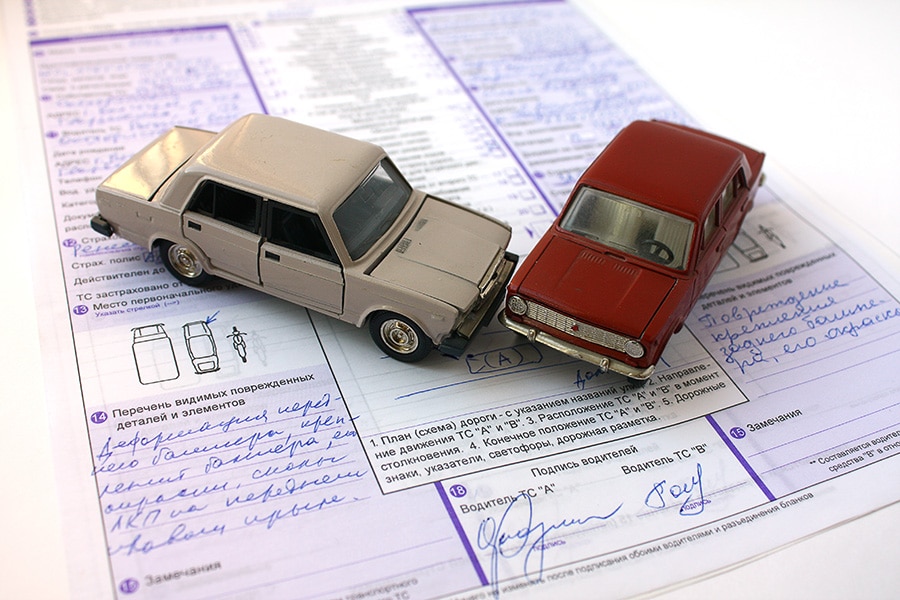

Car accidents are often terrifying experiences. People can be injured, vehicles may sustain serious destruction, and property damage may occur. But having proper coverage and a caring, professional insurance agent can make the situation a little easier to handle.

Car Accident Claim Time Limits

Every state has a time limit in which legal action must be taken to file a personal injury lawsuit, referred to as the “statute of limitations.”

In Arizona, there is a two-year statute of limitations for filing a lawsuit for an injury that was caused by a car accident. This means that you have a time limit of two years from the date the accident occurred to file a personal injury claim against the at-fault driver.

A police report will establish the exact time of the event. This document can be used to prove to the insurance companies when the crash actually occurred.

It is always best to file a claim with your insurance company immediately after the incident. Doing this as soon as possible will give you the highest likelihood of a favorable outcome. Plus, notifying your broker will help ensure you meet the insurance company’s deadlines and that your claim is handled quickly.

Penalties for Late Filing

There are serious consequences for not adhering to the time limits for filing. If you file after the statute of limitations has passed, the court will reject your claim, even if you are only a few days late.

Although there are strict time limits to file a claim, you do not need to resolve your claim within the time limit period.

Insurance Requirements

Arizona mandates minimum insurance requirements that all drivers must maintain:

- $15,000 bodily injury liability for one person

- $30,000 bodily injury liability for two or more individuals

- $10,000 property damage liability

If the driver is uninsured or under-insured, the statute of limitations in Arizona may increase to three years.

Assigning Fault

Arizona is a comparative fault state. This means that whoever is at fault for the Arizona auto accident is responsible for paying for the damages.

However, comparative fault means that responsibility can be apportioned to multiple individuals. In other words, if you are in an Arizona auto accident and the other party was 60 percent responsible, you can sue for your damages, but your recovery amount will be reduced by the 40 percent of the liability that is yours.

After Filing a Claim

Once the car accident injury case has been filed and submitted, the insurance company will complete an investigation to determine what happened, who was responsible for the accident and review all the injuries. The good news for residents in Arizona is that there is no cap on damages in personal injury or car accident cases. The state’s laws allow you to recover for property damage, pain and suffering, medical bills, lost wages, and emotional distress that result from your auto accident.

Contacting your insurance company is one of the most important steps you must take after an accident. They will discuss the incident with you and negotiate on your behalf with the other party’s insurance corporation.

Experienced Insurance Professionals

When you contact Olson Insurance Company after an automobile accident, you’ll have the support of the same team that helped you select your original insurance policy. These insurance experts will guide you throughout the claims process and assure that your best interests are being followed every step of the way.

At Olson Insurance, we work to protect you from rate increases that can be triggered by claim requests. We’ll help you avoid unnecessary financial burdens and other situations that are easy to fall into when you don’t have the proper assistance for your auto insurance plan.

We Will Guide You

Filing a claim can be overwhelming. As an independent insurance broker, our skilled agents will sort through the contracts, policy language, and all the fine print. Insurance claim time limits are serious and the people at Olson Insurance will assure you meet all required timelines.

Few things are as traumatic as being involved in a car crash. Even if you are not hurt, there is the fear and uncertainty the accident leaves in its wake.

When you have been involved in an automobile accident and you experience damage to your vehicle, personal injuries, or other issues, contact Olson Insurance at (623) 583-7999, and let us walk you through the car insurance claims process from beginning to end. We will make sure you receive all the benefits you that you deserve.